How much does a Financial Advisor make in the United States? Average base salary Data source tooltip for average base salary. $73,199. Average $73,199. Low $36,254. High $147,790. Commission. $17,800 per year. Non-cash benefit. 401(k) View more benefits. The average.. The average annual bonus received by a financial advisor ranges from $2,000 to $31,000. The average annual profit-sharing compensation ranges from $995 to $18,000. The average annual commission.

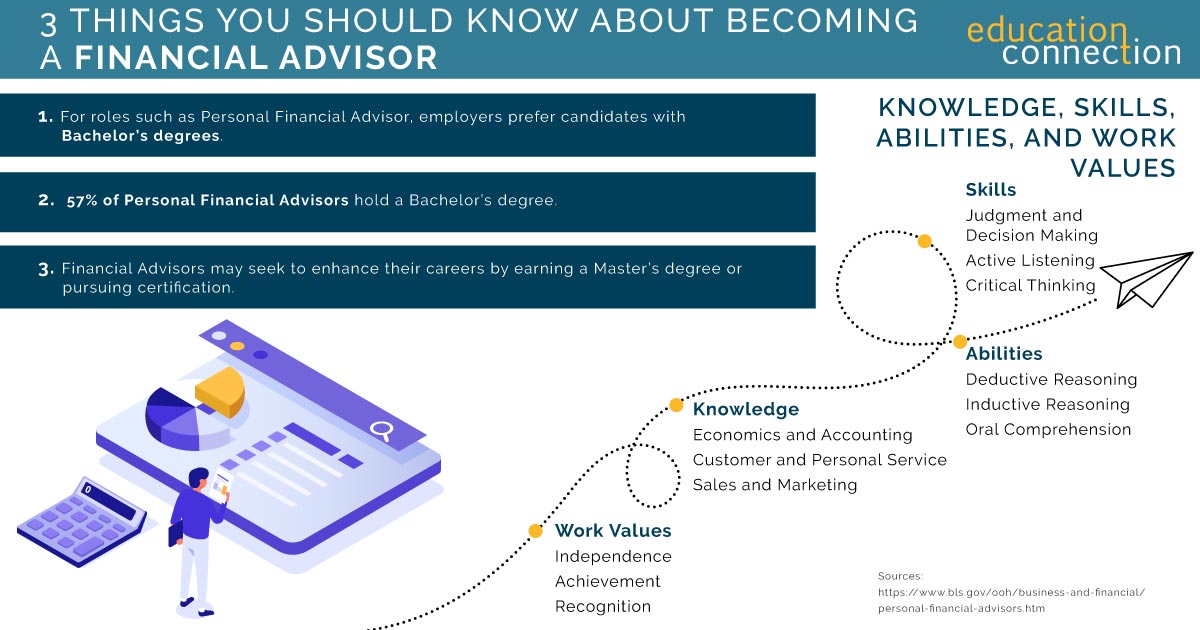

Ins & Outs Of Financial Advisor Online Degrees and Careers

How Much Does a Financial Advisor Earn? Salary, Course, Career YouTube

How Much Does a Financial Advisor Cost? story Wealthtender

What does a Financial Advisor do? How to an Advisor

How Much Does a Financial Advisor Make an Hour? The Enlightened Mindset

What Does a Financial Advisor Do?

Financial Advisor

.jpg)

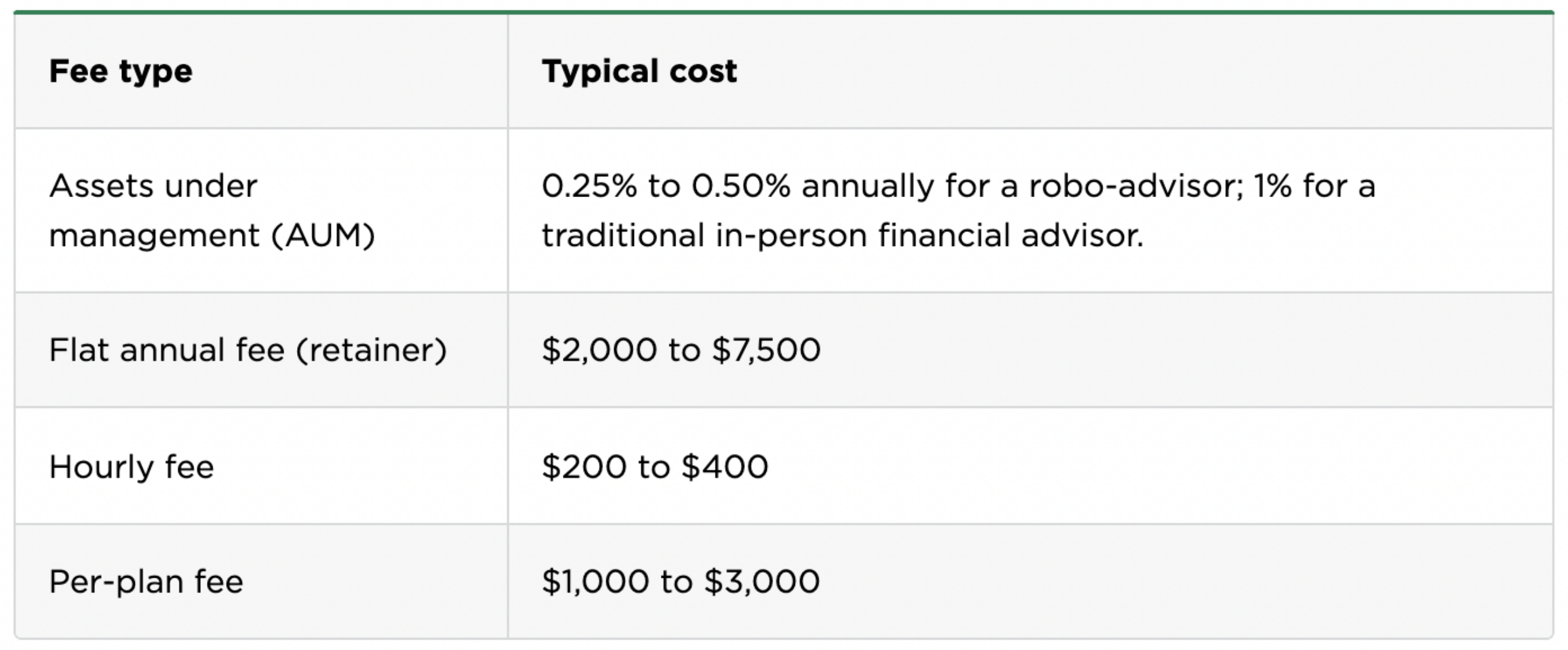

How Much Does a Financial Advisor Cost (And Do I Really Need One

7 Reasons Why a Financial Advisor is Important for Business

Financial Advisor Cost + Fees Explained YouTube

How Much Do Financial Advisors Make? Finance Strategists

How Much Does a Financial Advisor Cost? Urban News Now

How much does it cost to work with Financial Advisor?

How Much Does a Fidelity Financial Advisor Make? Overview of Salary

How Much Does A Financial Advisor Cost? — PharmD Financial Planning

How Much Does It Cost To Talk To A Financial Advisor?

FINANCIAL ADVISOR SALARY How much do Financial Advisors and

Financial advice isn't cheap, but most investors using an advisor don't

How Much Does A Financial Advisor Cost? Insurance Noon

How Much Does a Financial Advisor Cost?

According to the U.S. Bureau of Labor Statistics (BLS), the median pay for personal financial advisors as of May 2022 was $94,170 per year or about $45 per hour. That hourly rate is more than twice the $22.26 average of all occupations. However, new advisors typically start out earning more modest sums.. Step 1: Decide What Part of Your Financial Life You Need an Advisor For. Before you speak to a financial advisor, decide which aspects of your financial life you need help with. When you first sit.